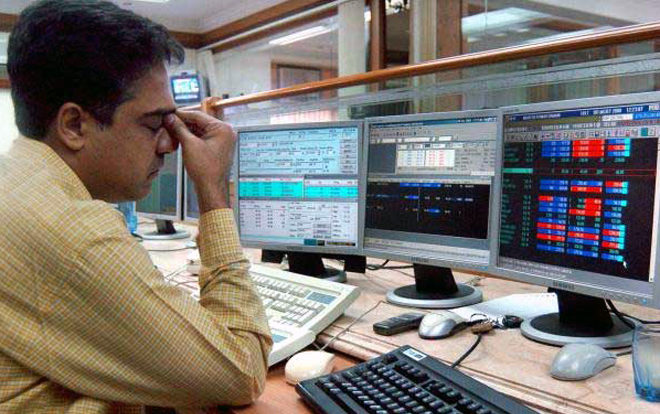

Today Sensex crashed by 1274 points to 33482 in the morning and then later recovered to 34195. Ultimately it landed about 561 points below yesterday. It is expected that 5.4 lakh crore is wiped out from the capital market in few hours. If we take the news from financial express around 10 lakh crore lost in last three days. The Indian stock market which is about 90 lakh crore of worth has today lost huge amount.

http://www.financialexpress.com/market/about-rs-10-lakh-crore-wipes-off-from-indian-stock-markets-in-3-days-sensex-loses-2400-points/1053452/

Why and how this happens? Let us analyse from a layman point of view.

Stock exchange is IDEALLY designed to invite partners in your business by asking them to invest in your Industry. There are various derivatives as Shares, Debentures and other derivatives etc to invite common man. When a common man invests he feels that he is investing because he cannot start a business on its own so let him be a partner/share holder in any industry/enterprise.

When company A asks public to invest, investors are to bear loss or earn the profit as the case may be. Now how does a common man judge whether he will earn or loose in his investment is by judging the share price of the company, which is quiet fabricated. It is not actually linked to the profitability of company. IDEALLY it should be but it is not. The share prices can be easily fabricated.

Companies do require a big amount to be invested. If ordinary Indian cannot invest, then government started mutual funds scheme, where by even small investor can invest. Till now the identity of the person investing is kept with SEBI and the company itself.

But the worst happened when government of India introduced the participatory notes practice, whereby anyone can invest without disclosing the identity. Usually termed as FII foreign institutional investors. Now government shows this money as foreign reserve and Indians are very happy to note the digits of foreign reserve only.

When FII invest the rate of share and hence the SENSEX so called increases and it is measured as the measure of ECONOMY. Without understanding that merely 5% of Indians are investing. Anyways the stock exchange booms.

One fine morning Participatory Notes owner plan to sell their stocks and take away the money back to their respective places. Now as government does not have the identity of investor nor any restriction on them ultimately the common man is looted.

But we still fool ourself by saying FDI in this form is the money invested in India so we should welcome it.